Intelligent Income

Dear Client,

Thank you for using Homestead Financial for your financial needs. Please read below for an update on our company and investment strategy. You can read prior newsletters at https://homesteadfp.com/category/newsletter/

Investment strategy

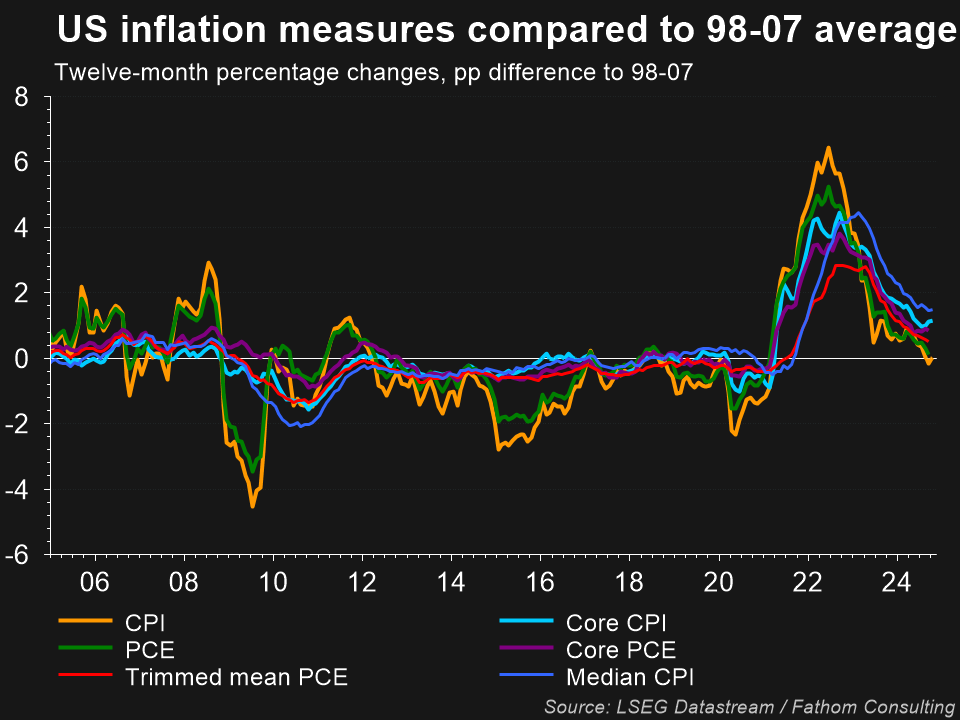

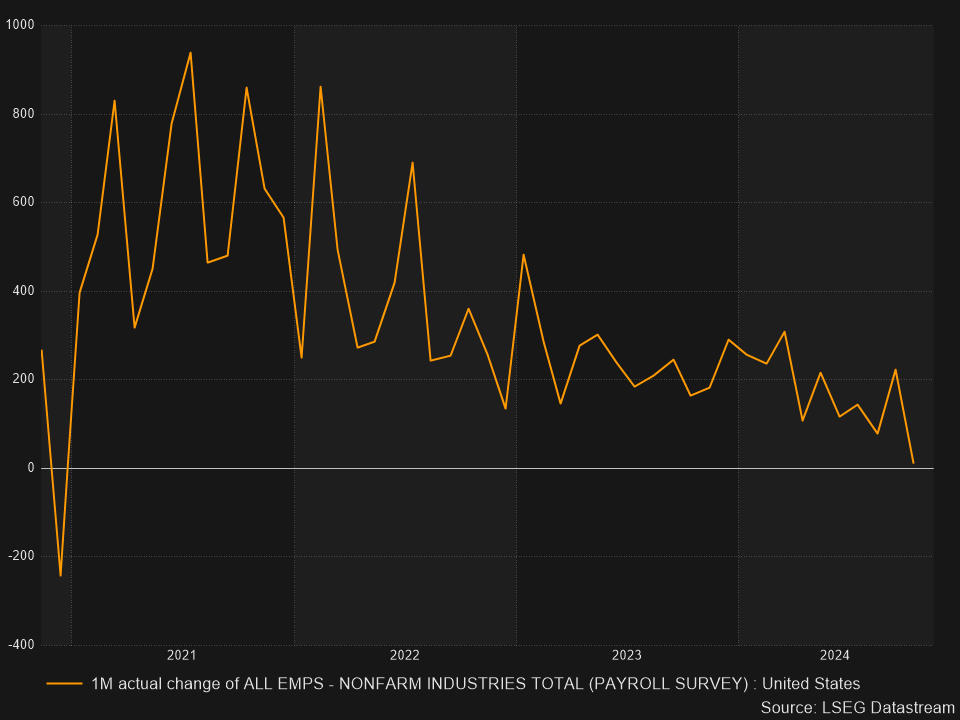

The Homestead Income Portfolio gained a little over 16% in the first three quarters of 2024, consistent with dividend ETFs (~15-17%) and a broader universe of 76 income-oriented equity funds (~15%). Value stocks (+15%) lagged growth (+23%) against a backdrop of ebbing inflation, lower interest rates, and tighter credit spreads. Interest-rate sensitive sectors (manufacturing, durables, housing) remained weak and the labor market soft, but fears of an acute recession faded as stable employment data provided additional hope for a soft landing. With respect to valuation, investors continued to favor risk, supporting elevated valuations for expensive segments of the market (US growth) and resurrecting more speculative assets like cryptocurrency.

politics and markets

With the US election in focus, I thought it would be helpful to review the role that politics has played in markets in recent history and provide some thoughts on how a Trump administration might affect investment strategy at Homestead. The investment community likes to discuss politics for the same reason the media tracks the polls–it’s thought provoking, entertaining, and grabs attention–but the reality is that politics normally don’t influence markets. The narrative among investors is that Republicans are better for markets because of their focus on free market ideology and tax cuts, however, on closer examination we find that markets have outperformed under Democratic administrations by a margin of 11 percentage points. Looking instead at performance in the first year of a transition in leadership, there is some evidence of better market returns when Republicans take office (+12% vs -36% for Dems) but even this relationship is tenuous. There are theories about which year of an administration is best (third year +14% vs first year +6.2%) and whether gridlock (split government) benefits markets by stabilizing policy so investors can discount the future. The truth is that all of these statistics are skewed by recessions or other factors, which have little to do with politics. For example, in recent decades George W preside over both the dot-com bust and global financial crisis, tainting returns for Republican leadership.

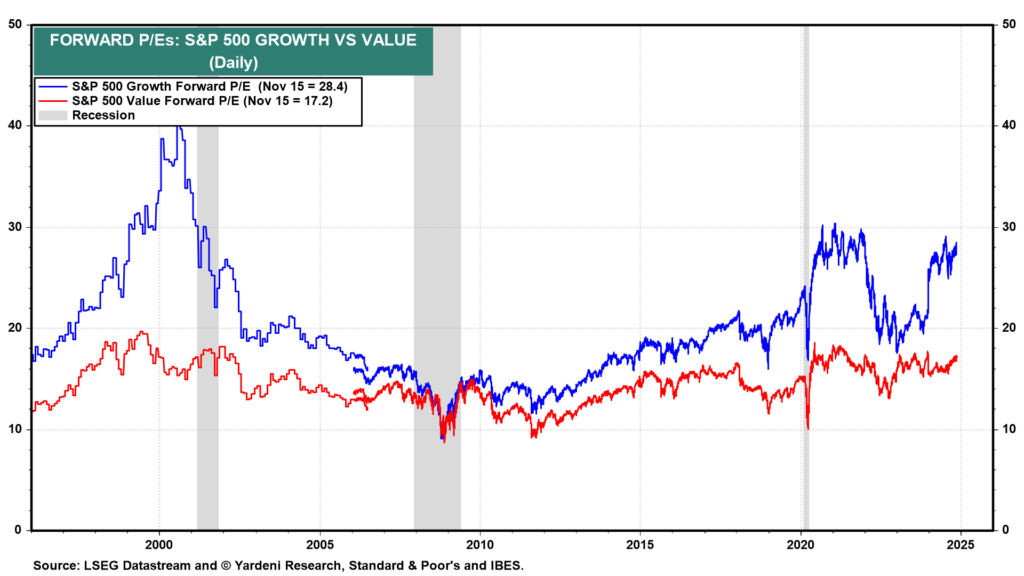

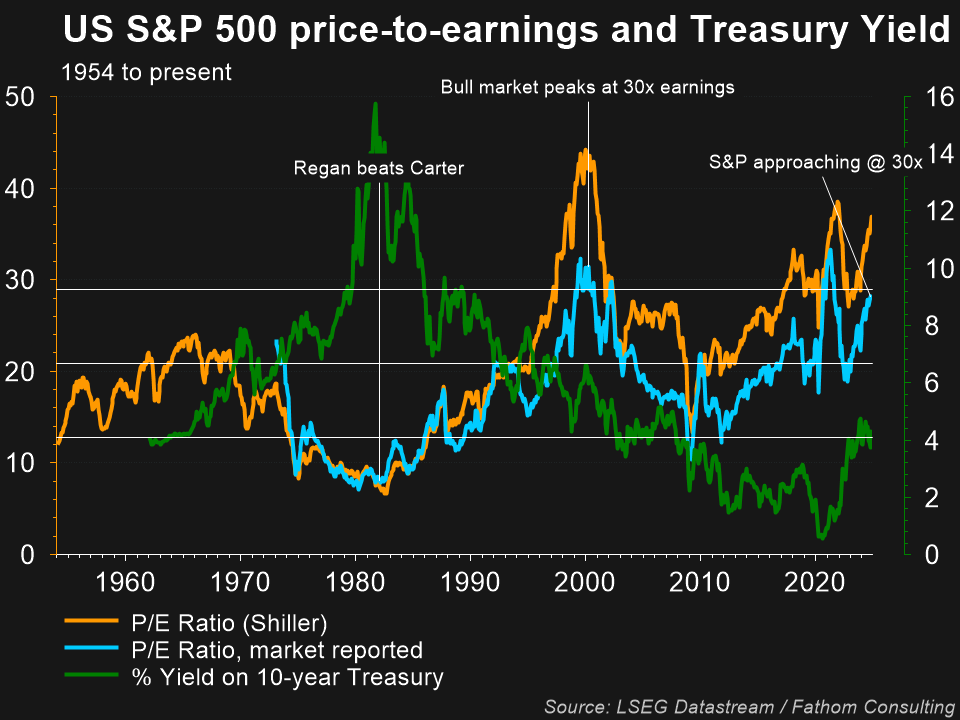

In a similar vein, some credit the Reagan administration with igniting markets in the early 80s, but examining this period through an broader lens, valuation emerges as the primary driver behind exceptional returns for US stocks during the 80s and 90s. Simply put, Stocks were a bargain after a period of high interest rates and inflation in the 70’s, providing room for prices to increase and valuations to improve over the following two decades. From 1982 to 2000, the S&P returned >800% (14% per year) while earnings increased just 130% (5%) per year. The difference between these growth rates reflects an increase in the price investors were willing to pay for earnings. In 1982, investors were willing to pay $9 for each dollar of earnings derived from the S&P 500 (cheap), but by the late 90’s they were willing to pay $30 (expensive). If you bought the S&P at the peak of the dot-com mania in 2000, the next 18 years would have returned just 80% (a little over 3% per year). As value investors, we focus on more tangible measures of value (earnings, assets, etc) to justify our investment decisions at the security level, and only consider externalities like politics insofar as they directly influence these variables.

looking ahead

While it is true that the market normally disregards politics, it is not lost on Homestead that a Trump administration with a unified government and the backing of Elon Musk represents a new dynamic worthy of analysis and consideration. Unlike his first term, it appears that Trump will enter The White House with a running start. He’s also backed by the worlds richest man, who has set his targets on reforming government using unconventional methods. It’s a backdrop unlike any we’ve seen in recent decades, though there are some parallels to the early 80s when voters embraced conservatism. Trumps agenda will face obstacles from Democrats and moderate Republicans in congress, and this may limit the number of proposed policies that actually get implemented. At this point it’s difficult to determine which policies will come to fruition, however some key trends that seem likely given Trumps stated goals and powers:

- Global trade will continue to face pressure as we recoil from a prolonged period of free trade

- Immigration will slow and potentially reverse

- Deficits will expand on tax cuts

- Deregulation may increase the velocity of money and economic growth

- Economic and military conflict will remain features of the geopolitical backdrop

Most of these developments indicate higher inflation, elevated interest rates, and increased tail risk for markets.

managing uncertainty

Markets like certainty. A stock that grows earnings consistently often trades at an expensive valuation while one that falters from time to time gets a discount. It is also true that perceptions of risk can be as influential as the risk itself. If investors expect uncertainty they will discount those expectations today even if things appear fine at present. As value investors, we look to own good companies that reflect low expectations and trade at discounts sufficient to provide us with a return on our capital. Counterintuitively, this can involve buying things that appear risky when in fact they are not.

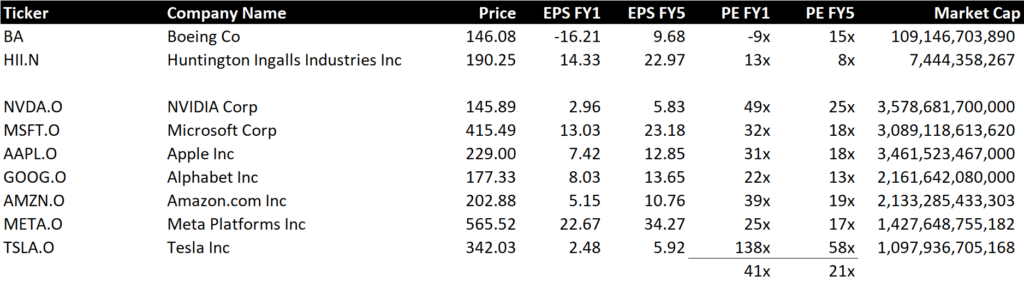

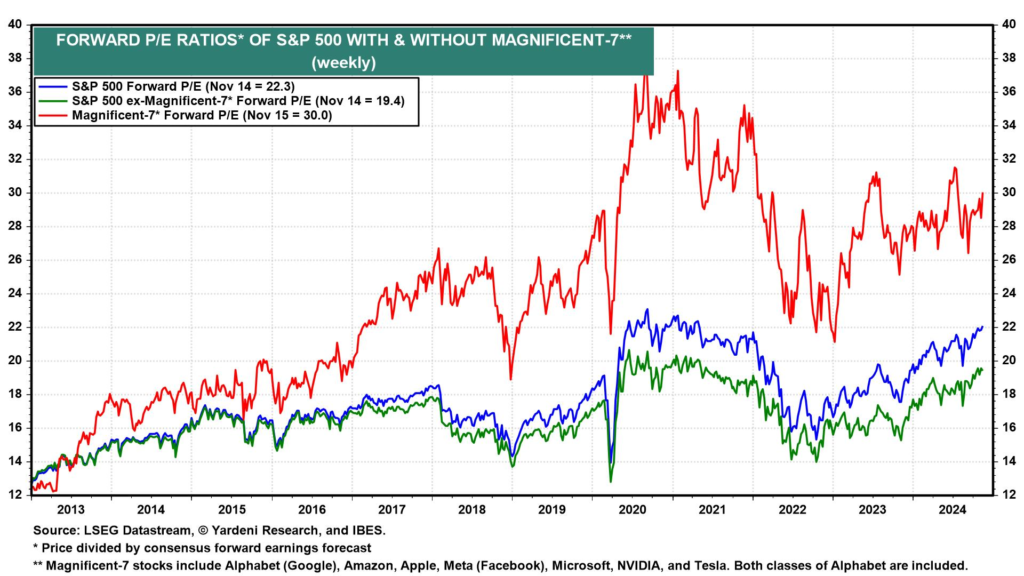

Two of our holdings, Boeing (airplanes) and Huntington Ingalls (submarines), struggle with production setbacks while their order backlogs continue to grow in size. Earnings are under pressure now, however both companies have a history of profitability, enjoy strong demand for their products, and have wide competitive moats. Assuming conservative estimates, these companies trade for around 10-15x what they earn in a year and have a record of returning capital to their shareholders. Compare them to the Mag 7, which analysts expect to double earnings over the next few years from a level that is already up more than 200% from 2019 (as an aside, this implies they will earn 1/3 of all corporate profits in the US). Today the Mag 7 trades for around 40x what they will earn next year and 21x what they are expected to earn in 2030, a price that is 4x more expensive than our two industrial stocks. We don’t know what will happen over the next five years, but we can deduce from these figures that investors expect a lot of growth from the Mag 7 and expect very little from Boeing and Huntington. In a fluid environment characterized by greater macroeconomic uncertainty, it is better to to own companies like ours with cheaper valuations because they already have low expectations, which serve as a buffer against risk.

At of the end of the third quarter, the Homestead portfolio traded with a projected earnings yield of 7.2%, a projected dividend yield of 2.7%, and a growth rate of between 5-6%. Add the earnings yield and the growth rate together and you get around 13%, a figure that matches the annual return for the Homestead Income Portfolio over almost 13 years. The math is easy. Patience and discipline are the hard part.

Sincerely,

Supplemental Charts

inflation easing

lower Short rates on Fed easing

long rates remain elevated

tight credit spreads

Weakening labor market

growth vs value, Growth remains expensive

valuations drive returns

S&P was cheap in the early 80s. How will it fare if rates increase?

cryptocurrency market capitalization $3 trillion

us dollars in circulation $2.3T

Mag 7 and S&P

valuation and growth expectations for mag 7 vs two homestead industrials