Intelligent Income

Dear Client,

Thank you for using Homestead Financial for your financial needs. Please read below for an update on our company and investment strategy. You can read prior newsletters at https://homesteadfp.com/category/newsletter/

Investment strategy

In our last post (Once More Unto The Breach, December 2022), we canvassed the dramatic selloff in risk assets in 2022. Richly valued growth stocks, long dated treasuries, and digital currencies declined by more than 30%. Few parts of the market were left unscathed; cash and short dated treasuries survived along with cheap value stocks. Homestead posted a modest decline of 4% compared with -18% for the S&P and -13% for the Barclays Aggregate index (bonds). At the time, we made the case for re-risking. In our view, valuations had reset providing cheaper prices and better future returns across a variety of asset classes. Growth was more reasonably priced relative to value, bonds offered more attractive yields at shorter durations, and value stocks continued to offer compelling returns.

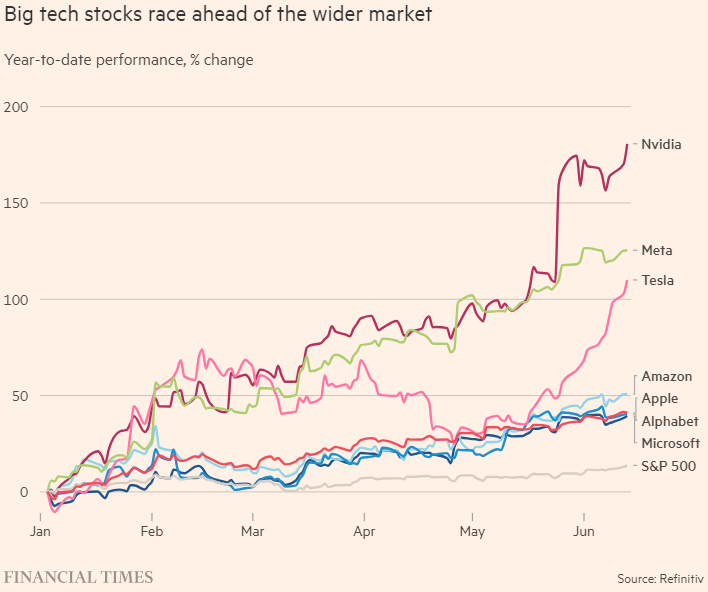

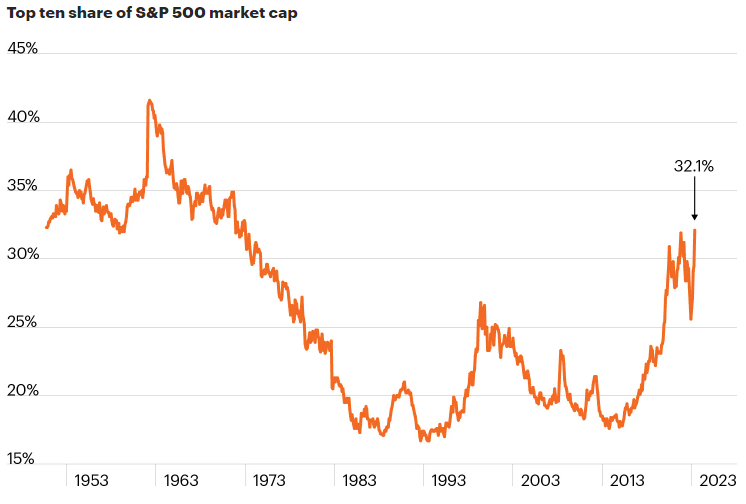

Fast forward to August 2023 and the world looks a little more like it did in January 2022. Most notably, large tech companies have regained favor among investors, pushing the S&P 15% higher year-to-date. If not for the seven largest companies in the S&P 500, returns for US stocks this year would be more like 5%.

A “narrow market” driven by a small group of companies is nothing new. It is a mirror image of the paradigm that dominated markets in the runup to 2021 and it is familiar to many investors who base their experience on recent market dynamics. But the truth is that over the long run, narrow markets have been more the exception than the rule and they tend to be exacerbated by low interest rates. Apply a higher discount rate (the required rate of return) and investors become less willing to speculate on investments with higher valuations and lower prospective returns.

The Discount Rate

Which brings me to the next topic of discussion and perhaps the most important development over the last six months—the discount rate. All of investing relies on relative rates of return. If I can earn a sure 5% on a US treasury bond, why bother with a stock that pays no dividend and trades for 40x what it earns in a year? By the same token, why own a piece of real estate with no cash return or a piece of digital currency?

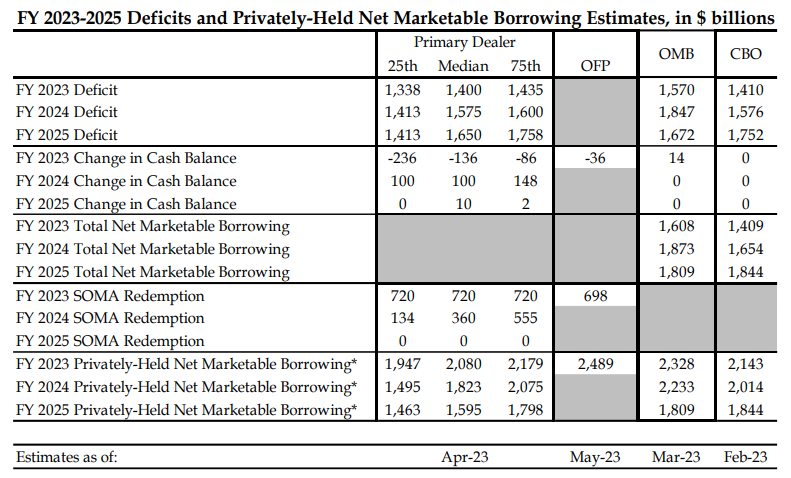

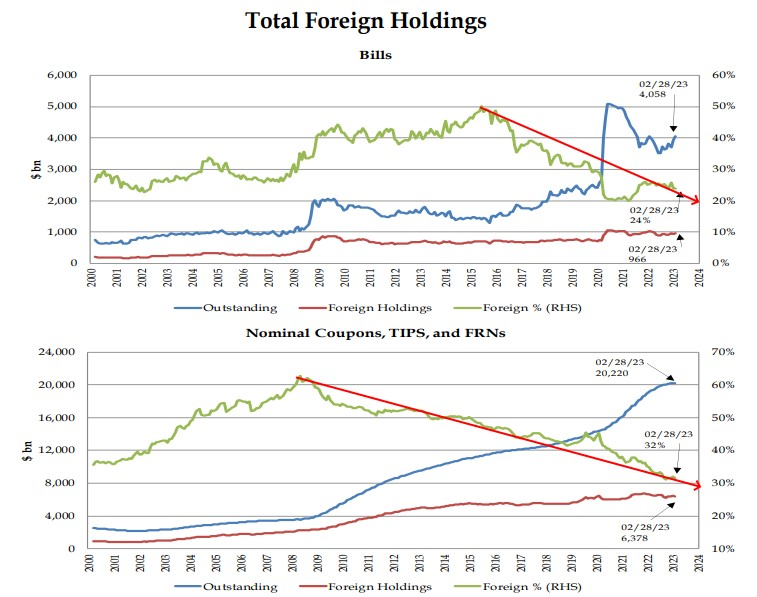

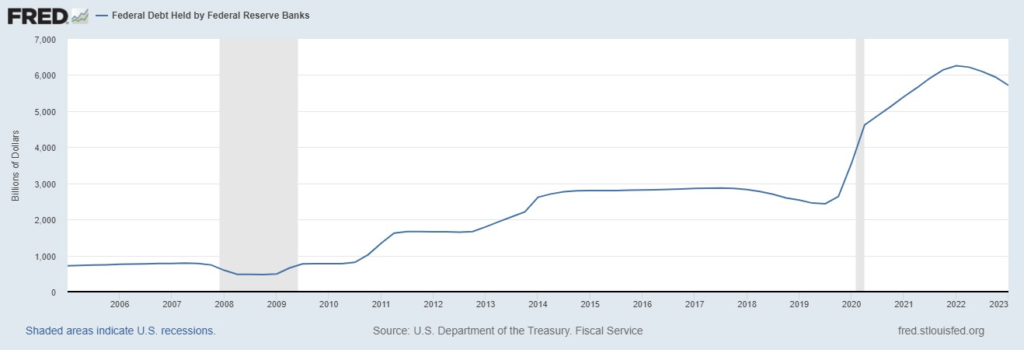

Over the last few months, what started as fed-induced tightening at the short end of the interest rate curve (less than one year to maturity) has migrated to the long end of the curve (10+ years). Even more shocking, this has occurred while inflation measures have declined, suggesting that the market rate for longer dated treasuries may be searching for a new equilibrium. While the market rate of interest is devilishly hard to predict, investors should realize that the supply of treasuries could be flirting with insufficient demand, pushing rates higher. Consider the drivers: 1) less foreign buying from Asia, 2) quantitative tightening by the federal reserve, and 3) increased net issuance to fund growing deficits.

2019: 87B per month

2022: 100B per month

2024: 170B per month

The Case for Value

It may be that the recent rise in interest rates reflects temporary “technical” factors like increased borrowing in the second half of 2023 following the debt ceiling standoff earlier this year. If so, interest rates could recede from current levels. However the case for higher yields on US debt at some point in the future seems to grow stronger by the day given secular trends noted above. For that reason investors should think carefully about the implications. At Homestead we approach this problem in the following way:

- Avoid assets that trade at high valuations relative to cash flow (and therefore imply low discount rates). These investments are subject to repricing risk. Examples include everything from growth stocks valued at 50x earnings to money-loosing venture capital investments.

- Manage exposure to leverage, particularly assets with refinancing risk. These assets may begin to compete with the government for capital, a condition known as “crowding out”.

- Limit exposure to duration where possible and apply appropriate discount rates for liquidity and risk of loss

We don’t know where interest rates will land, but we can control our exposure to the risk of higher rates (a risk that is no longer a remote possibility) by taking measures to insulate our assets from the potential fallout. In the vernacular of value investing, we seek a “margin of safety”.

firm update

Homestead is always looking for new ways to augment investment returns. Earlier this year we implemented a cash sweep to systematically move excess cash balances to money market funds paying upwards of 5%. This helped to reduce the “cash drag” often present in mutual funds and separately managed accounts. Clients should also know that we can help deploy cash balances in the bond market at rates above savings / CD / deposit yields on offer at most banks, with no withdrawal penalty or liquidity constraints (thank you Jerome Powell).

On the technology front, this quarter we invested in a new tool that provides AI-generated summaries of transcripts, press releases, and other company documents to accelerate our research process. We also look forward to implementing new portfolio management tools in the fourth quarter.

In the world of investing, the tools and process continue to evolve but the discipline remains the same.

Thank you again for choosing Homestead Financial Partners and please don’t hesitate to reach out if you have any questions, recommendations, or just want to chat.

Sincerely,

Simon