Intelligent Income

Dear Client,

Thank you for using Homestead Financial for your financial needs. Please read below for an update on our company and investment strategy. You can read prior newsletters at https://homesteadfp.com/category/newsletter/

Investment strategy

The Homestead Income Portfolio gained a little over 9% in the first quarter of 2024, outpacing dividend ETFs (~6%) and a broader universe of 76 income-oriented equity funds (~7%) on good performance across several of our holdings. As always, there were some misfits dragging down the portfolio (BA) while others provided support (DIS, AVGO, GM). Our allocation remains conservative, with equities tilted to defensive sectors of the market and fixed income constrained to short duration investment grade. Holdings were rebalanced this quarter and no new names were added to the portfolio.

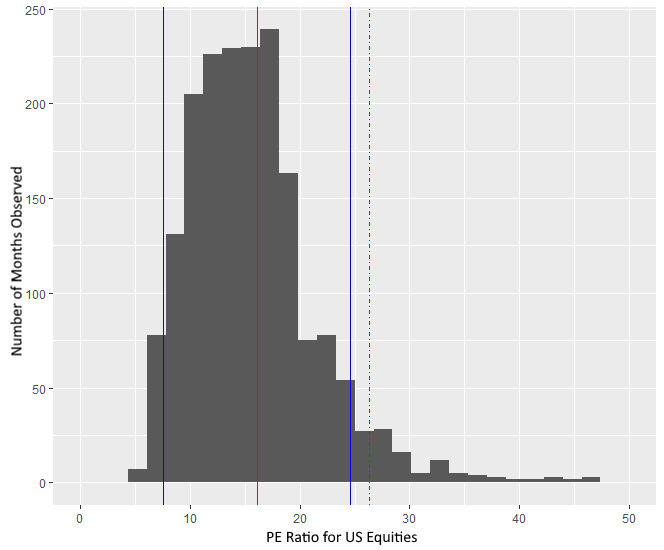

The market backdrop remains risk-on, with speculative excess apparent in pockets of the market: since 2022 Bitcoin +240%, NASDAQ +40%, and gold +25%. The S&P 500 trades at a historically rich valuation of 26x earnings despite a sustained increase in interest rates at both the long (4.5% 10 year) and short (5% 1 year) end of the yield curve. Companies perceived to be exposed to AI have been particularly buoyant, driving valuations in the technology sector to 35x earnings. For perspective, the chart below summarizes a count of monthly observations of price-to-earnings ratios for US stocks since 1871, ranging from a low of 5 (Great Depression) to a high of 45 (dot com 2000, post-pandemic 2021). Note that on average, the index has capitalized earnings at ~16x (solid red) with a standard deviation of 8x (blue) and a current value of 26x (dotted red). At 26x earnings, clearly the market, and technology shares, are expensive based on historical measures though not at nosebleed levels of 2022. This helps to explain why Berkshire Hathaway ended the quarter with close to $200 billion in cash.

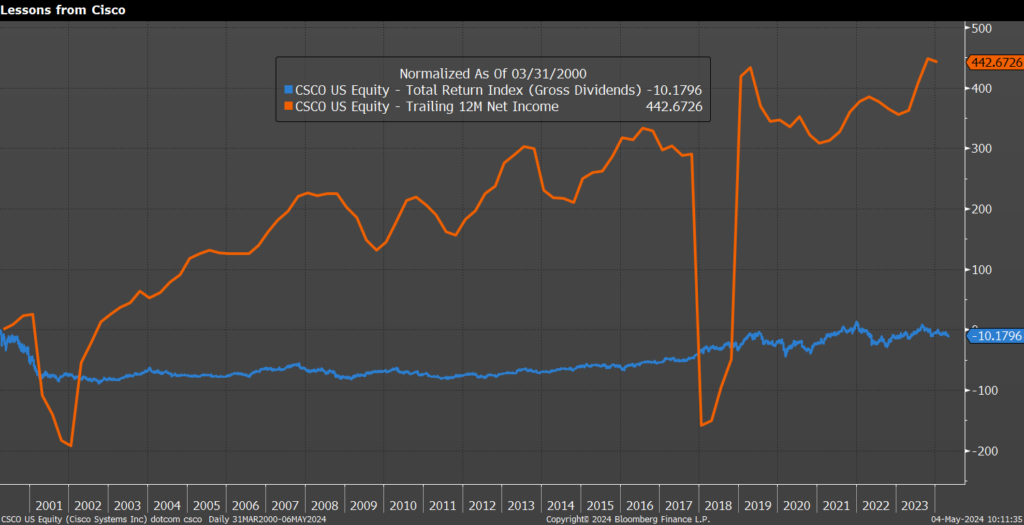

AI is a topic that deserves some attention given its prominence in markets and the news. Homestead views AI as a disruptive and transformational technology, much like the internet and the PC that came before it. It will further democratize information and increase productivity across the economy, acting as an additional layer of abstraction on top of the internet. Like the internet companies of the 90s, the firms selling AI hardware and software (NVDA, MSFT, FB, etc) trade at lofty valuations reflecting investor excitement around the technology. While acknowledging the potential of the technology, we nevertheless approach the space (and its expensive valuations) with caution. Similar to the Dot Com boom, there will be winners and losers and it’s hard to say which companies will ultimately prevail. The market is betting on NVDA at the moment, but how durable is their competitive position? How will new AI capabilities and workflows impact trillion dollar tech giants that were built for a pre-AI world? Cisco dominated the business of selling networking gear at a time when investors were head-over-heels for the internet, but those who purchased its shares in early 2000 would still be showing a loss today, 24 year later, even though earnings grew more than 400% over the same period.

Price is what you pay…value is what you get.

Homestead chooses to focus more on the overlooked and underappreciated segments of the market, where investor expectations are low, downside is more limited, and the potential for positive surprises exists. Good companies with inexpensive valuations may not directly sell or produce AI but can still benefit from the technology as users and enablers. Take for example the recent Bloomberg article on Tyson Foods, which uses robots equipped with vision and machine learning to debone chicken breasts, or the utility companies that will furnish electricity for power hungry data centers while helping to bridge decarbonization, re-industrialization, and electrification. As value investors, we aim to own companies that will continue to participate in economic growth, avoid disruption, and return capital to us in the form of dividends and share repurchases. This means avoiding victims like Getty Images while owning firms like Avago.

firm update

Homestead continues to grow steadily through client acquisition and appreciation, with assets totaling more than $13 million in the first quarter of 2024. My focus remains on managing our accounts with a high degree of attention while selectively adding clients through referrals and word-of-mouth. In that vein, I continuously look for ways to sharpen and improve the investment process, from research through execution. During the quarter I began trials for three additional research tools to enhance access to macroeconomic and company-specific data, and gained access to a new rebalancing software that will streamline and automate portfolio management, freeing up more time for investment research.

I’ve reduced the detail and frequency of updates on my website to make it easier to comply with increasingly strict regulatory guidelines. Moving forward, I intend to provide quarterly account specific updates via email with more high level commentary on the website on a quarterly or semiannual basis. As always, don’t hesitate to reach out if you have any questions, recommendations, or just want to chat.

Sincerely,

Simon